By Kimsey Hollifield

(Editor's note: The effects of the Coronavirus Pandemic present a rapidly evolving situation not only for the economy but for our health and wellbeing as a whole. Please update yourself regarding real-time information and news as it relates to your own financial picture.)

It’s been a rough couple of weeks for American investors. I read that Jeff Bezos lost 18 billion this year. But I’m not talking to the head of Amazon here. I’m directing this to regular investors who are looking at their 401ks, IRAs, and brokerage statements. You’ve saved money for years, and now you see it vanishing before your eyes. In particular, I want to give some advice to the 50+ crowd. Y’all are closest to retirement, and because you have a shorter time before you need to use your money, these big dips in the market hurt you more than the younger crowd. Let’s put this whole thing into perspective:

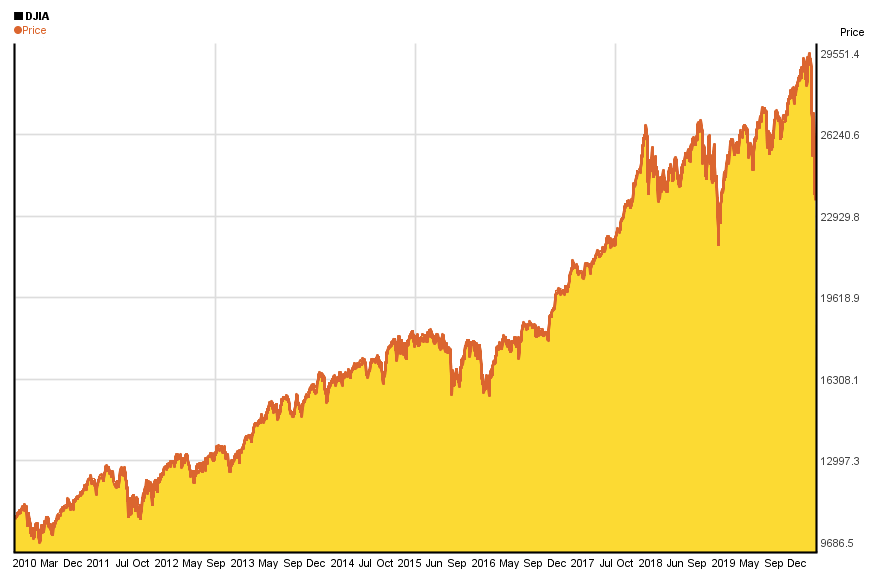

For starters, we live in a 24 hour news cycle now. That makes it so hard to take a long view of your money. One day the market is up, the next day the sky is falling, rinse and repeat. The Dow went way up over 29,000 recently. Sure, if you cashed all your stock out on the specific day the market hit an all-time high, you would be jumping with joy. You might also be under investigation from the SEC, and when they find your crystal ball, you might be in trouble. As I write this, the Dow is all the way down to 23,185 and it’s taken down your accounts right with it.

Let’s go down memory lane a minute. Do you remember sitting with your family on Christmas Day in 2018? The stock market had just gone through the worst 4th quarter since The Great Depression and had the worst Christmas Eve ever. You probably said to yourself, “if the market goes back up some I’m moving some of this money to safety.” At that moment it was at 21,792. With all that’s happened, the market is still higher than it was then on that Christmas Day!

Let’s go back further. On February 11, 2016, the Dow was about 15,660. That means right now it’s still apx 36% higher in the past 5 years. They don’t say buy low and sell at the all-time top of the market. They say buy low, sell HIGH. The market is still really high. It may not be an all-time high, but it is not as low as it could be. Also, with recent dips, many retirees and pre-retirees are having a lot of sleepless nights worrying about money you can’t afford to lose. Why are you still risking it?

It could get worse. Way worse. In 2008 the financial crisis happened, and the market tanked. You lost almost half your money in a short time and the market went all the way to...6,547! That number doesn’t seem real, but it’s completely accurate. Many retirees had to go back to work. Many pre-retirees had to delay retirement because they lost so much money.

The market today is almost 4X what it was then. If you are 55-65 years old, what are you waiting for? Think of it this way: if you went to the casino with $6,500 and masterfully gambled your way to over $29,000 would you not be excited? Then what if the cards turned on you like they have in the past 2 weeks and you lost down to $23,000. At some point you would slow down, put your chips in your pocket and cash out, right? Would you risk the $23,000 you had trying to get back to $29,000 or would you be happy about your big win?

That’s where you are in the market right now. Please note that I’m not saying to cash out all your stocks and mutual funds and hide it under the mattress. I’m simply saying there is a portion of money you cannot afford to lose and that money should be in a safe place that gives you peace of mind.

Build the house. I often use the illustration of a house with my clients. When you’re building a house, the first thing you have to have is a solid foundation. It’s the same with your financial house. You need to first come up with an amount of money to put into your foundation account. This account should have zero market risk and be able to provide you a reasonable rate of return. You should have complete peace of mind that this money will provide for you through retirement.

The walls and roof… this is where you get to have fun and take some risks. Some like modern architecture, some people like a more traditional style. Likewise, for your financial house, this is the bucket of money that you can be a little more aggressive with. I’m securities licensed, so when I’m managing a client’s accounts, I try to keep the fees and standard deviation as low as possible. That’s just a way of saying that we try to get the client the return they want with the least amount of risk. If you have your safe foundation account levels where they need to be, you can stand some volatility in this second bucket of money. But if you don’t have your safe foundation in place, none of this really matters.

Imagine building your house directly on the sand with no foundation and a hurricane was coming. It would seem ridiculous if you frantically started repainting and moving furniture around to protect yourself from the storm. It’s obviously not going to do much for you. Likewise, if a major market correction hits, it doesn’t matter if we move you from one mutual fund to another if you don’t have the appropriate amount of risk/safety.

I’m a big believer in age-appropriate levels of risk. If I have a 25-year-old client, we aren’t worried as much about the ups and down of their accounts because they have a ton of time before they need their retirement dollars. As you get into your 40s, you have to be a little more careful and try to minimize those losses you had time to ride out in your youth. When you finally hit 55–60, you need safe money. You have to stop chasing huge returns and set yourself up for providing income for the retirement years.

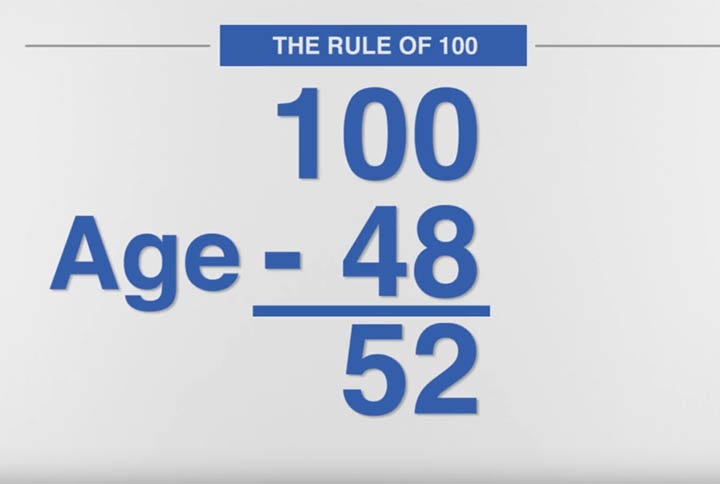

We use a strategy called the rule of 100. You take your age and minus it from 100. Whatever you have left is the percentage of your money you can risk. For example, if you are 50, you can risk half of your money while keeping half in safe accounts. If you’re 80, 80% of your money should be safe while limiting your risk to only 20% of it. This is obviously just a guide to show you how aggressive you’re being relative to the standard.

Everyone’s situation is different, so there isn’t one blanket recommendation for everyone. I just want you to understand that if you’re young and building for the long term, keep building and look at these dips as an opportunity. If you are older and moving into a different phase of life, there is no shame in protecting some of your money and walking away from the table with money you need to last through retirement.